Everybody want's to be as financially smart as possible – after all, why would you pay more when you don't have to,

especially not on such a big life decision like a house.

The property market is always changing, so doing this research once and sitting on it for a few months will offer little help. Going to open homes and auctions regularly will give you insight into the current state of the market and how much certain properties are going for.

One of our best tips is to look at properties in the suburb next to the one that you want. We find that first-home buyers in particular

usually end up buying in the more affordable suburb next door to the one that they first wanted to buy in.

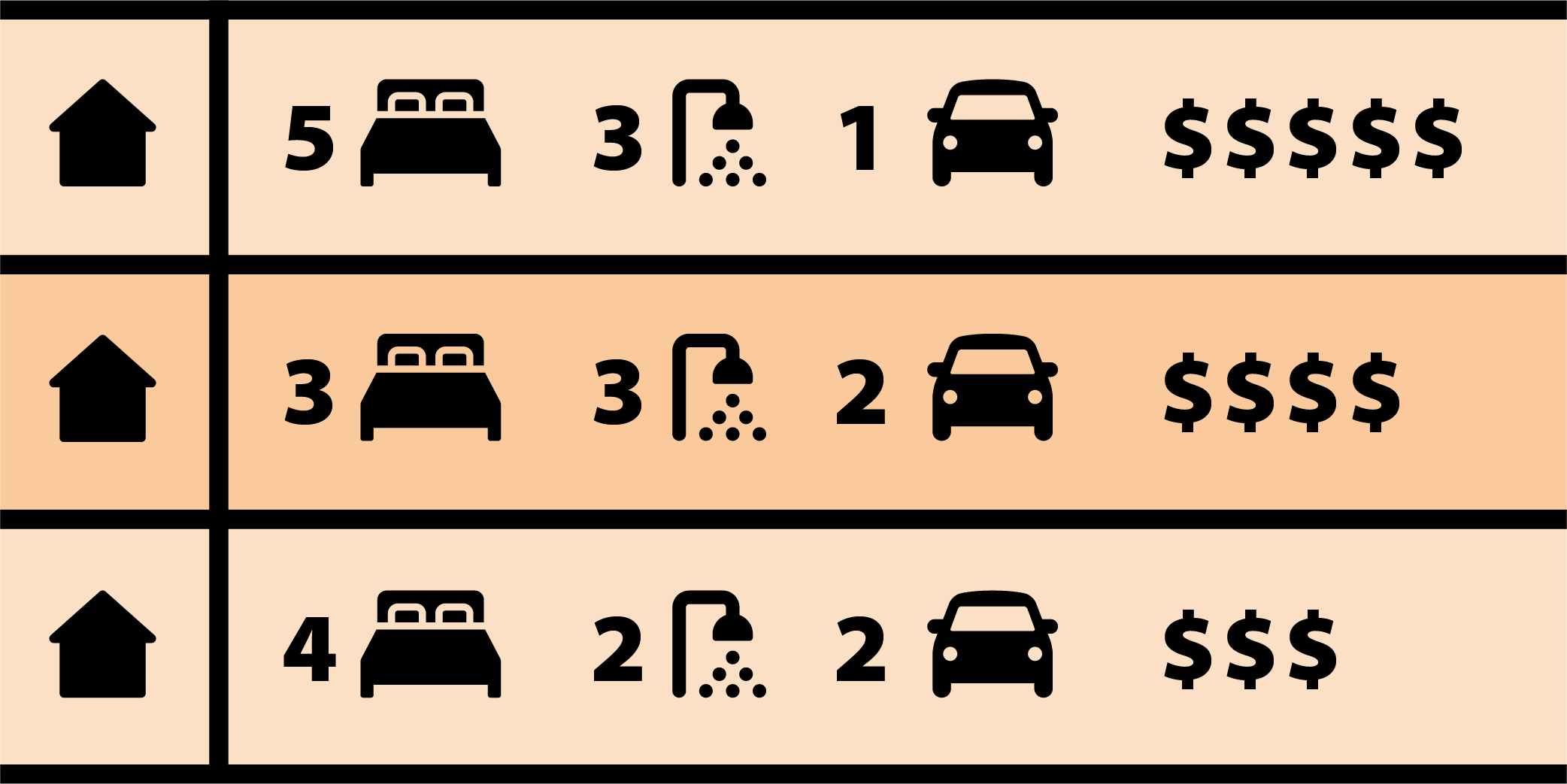

Comparing nearby properties that have sold recently is the best way to assess an acceptable price for the property you are looking at and

provides a valuable bargaining tool when you are negotiating with a seller or agent. Make sure the properties are comparable, with a

similar land size and number of bedrooms, for example, so you aren’t measuring apples against oranges.

Even if a lender approves you for a particular loan amount, it doesn’t mean you have to accept it – a higher loan amount means higher interest charges over the life of the loan, increasing the total cost of the property purchase, so only ever commit to a loan that you can afford alongside your current income and real expenditure. When calculating figures for the price of a home, ensure you also budget for maintenance and repair costs, as well as any other expertise you may require in the purchasing process, such as furniture or renovations. Check out our handy calculators for a guide on your borrowing power, budget planner, saving, and loan repayment.

We would strongly recommend using a buyer’s agent, as buying a home is one of the biggest financial decisions of your life and most people go in blind. If cost is a concern, then we would suggest maybe using them only for part of the process that you need help with, such as the negotiation or bidding at an auction.

Having a finance broker onside is key to avoid overpaying – they will search out the best loan for you and make sure it is one that you can afford. Contact our friendly team at Acquired, who will help you stay on budget, while still reaching your goals and becoming more financially empowered.

First Home Buyer

10 Tips for Property Investors

Moving Checklist